As the US equity markets have rallied back towards all time highs in October, we have received an increase in questions as to what’s driving the financial markets and what risks to consider going forward. We’ve provided some answers below, but as always please feel free to contact us if you would like to discuss anything in more detail. Thank you.

*Please note the comments in this text are only a synopsis of our opinions and should not be taken as investment advice.

WHY ARE MARKETS RALLYING SO HARD?

It is clear the month of October has resurrected the market’s bullish trend as most high beta securities, from TSLA to Bitcoin, have rallied significantly in a short period of time. Here are a few reasons as to why:

-

EARNINGS SEASON

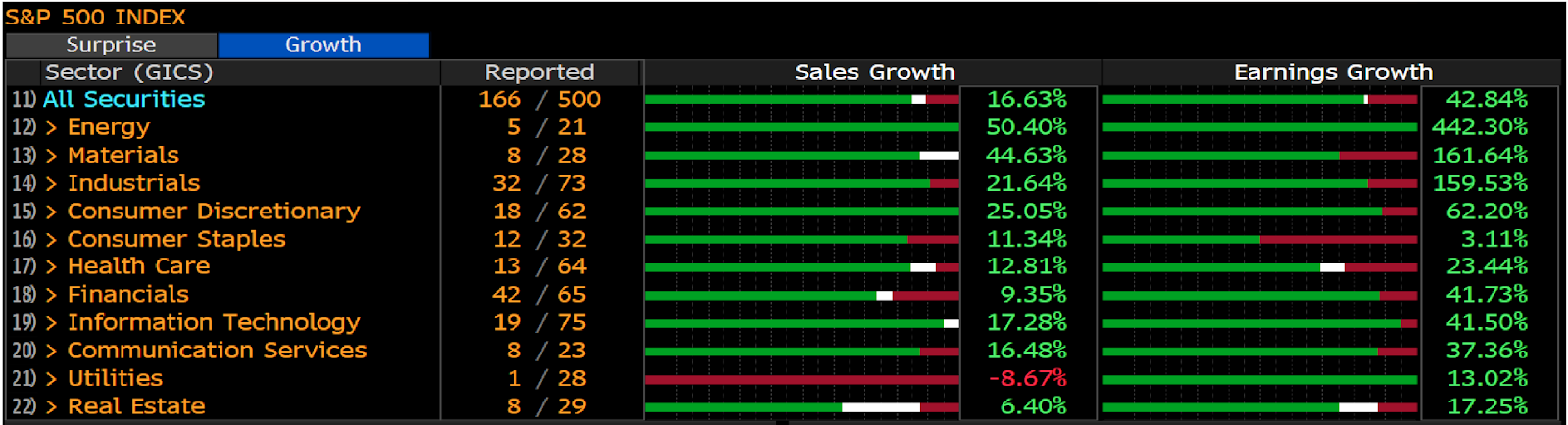

The periods leading into and through the early part of US earnings seasons have historically been positive for the overall equity markets as there is optimism for positive profit growth. The start of 3Q earnings reporting in early October has been no different, especially with many of the financials and some technology and industrial companies leading the positive commentary thus far. These sectors have been beneficiaries (or less impacted) by the positive economic impacts of covid. Going forward it will be important to monitor profitability and outlooks from consumer related companies who have still yet to report.

2. GROWTH

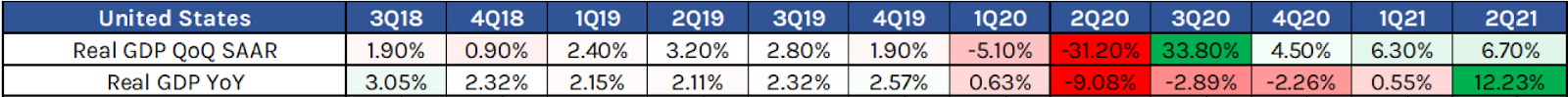

From a high level (using US GDP) we are currently in a period of strong positive YoY growth, albeit mostly driven by a weak base comparison from 2020 which saw the worst of the covid economic impact. Even though it’s likely these high growth levels aren’t sustainable, some computer driven macro models overlook this notion and focus purely on the current headline figures driving further bullish sentiment.

3. INFLATION

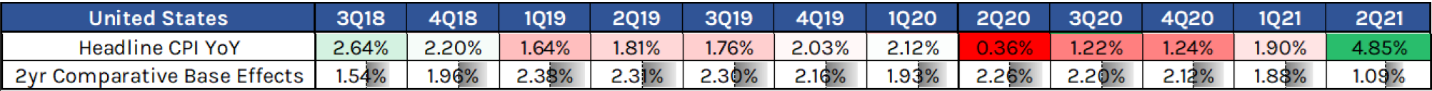

The discussions around inflation got underway in the beginning of 2021 and have only accelerated since then, along with the headline CPI figures. We are still experiencing the earlier stages of the inflation cycle in which it is a tailwind for many assets prices to rise, including stocks and real estate. There will be a period, potentially in 2022, when inflation becomes a headwind to cash flow driven assets. Many companies have already cited rising input costs, wages and supply chain issues as headwinds to profit growth in the near term.

4. COVID CASES DECLINING

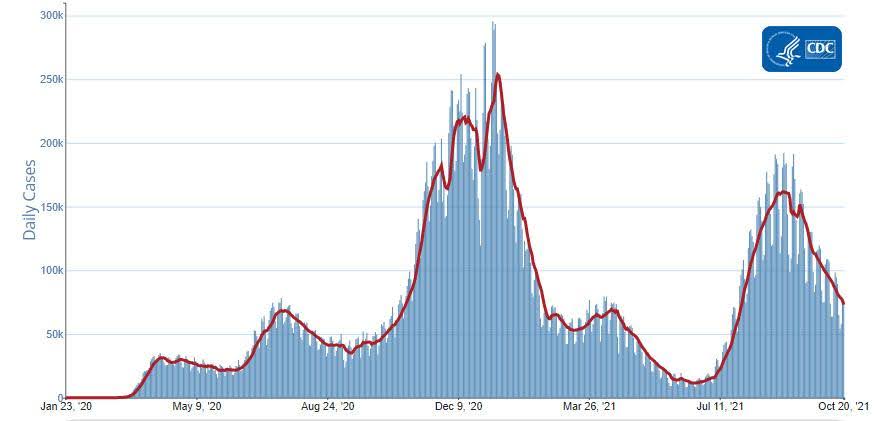

According to the CDC, covid cases increased materially through the months of July and August, causing many market participants to be concerned over the economic impact of the country’s reopening. However, since early September the number of daily covid cases in the US has been declining and more so the summer case rise had a less than feared impact on the overall economy.

5. DECLINING CONCERN ON TAXES

The recent political debates around government spending, stimulus and taxation continue to incrementally come in better than the worse case fears of broad based tax hikes on companies, investors and the wealthy. These issues are likely to remain on the table for the foreseeable future, but at least for now (2021-2022) the worse case scenarios seem to be less likely compared to expectations even a few months ago.

6. POSITIONING & MOMENTUM

One important factor that led to the sharp rise of asset prices in October was the negative positioning in September which saw those who were concerned of delta cases, rising rates, rising inflation, etc exit their positions and created a negative skew (visible in protection related assets such as TIPS and option premiums). This risk off sentiment in September created a negatively biased setup entering October, which allowed for more positive factors (many mentioned above) to play out and gain more momentum than what would have otherwise been the case. Momentum (currently one of the strongest factors) turned positive in the beginning of October and quickly gained further traction through out the month as many were forced to cover their short or underweight positions from September.

RISKS TO CONSIDER GOING FORWARD

-

FED

The Fed has an important meeting on November 3rd, which at this point has a high likelihood of some commentary around their asset purchase tapering plans. We can debate the importance of this single announcement or overall tapering action, but the larger question is how will the Fed manage rates (and ultimately the market expectation of rates) going into what is likely to be a higher inflation, moderate to lower growth environment in 2022. We believe the Fed is behind the curve in terms of managing inflation, which poses a two-sided risk of whether they feel forced to raise short term interest rates (less likely in the near term) or allow inflation to impact the overall economy (more likely in the near term).

2. INFLATION

Even various Fed members, who we believe overall are meaningfully behind the curve on inflation, have started to admit that their initial take on inflation as being mostly transitory (aka temporary) has proven inaccurate. We are seeing wide spread inflation across energy, food, building materials, labor, etc. Inflation is being driven by several factors (which has not always been the case historically) including covid impacts, domestic and international supply chain bottlenecks, labor shortages, government stimulus and low interest rates. Even though inflation thus far has been largely positive for asset prices, many cash flow driven assets (aka companies) have expressed headwinds to both revenue and more so profits due to the challenging cost, labor and supply chain environment. If this were to persist, especially without robust economic or consumer growth to offset the inflationary pressures, we would then begin to experience more of the negative impacts from inflation. It’s also worth mentioning we have not experienced this level of inflation since 2008.

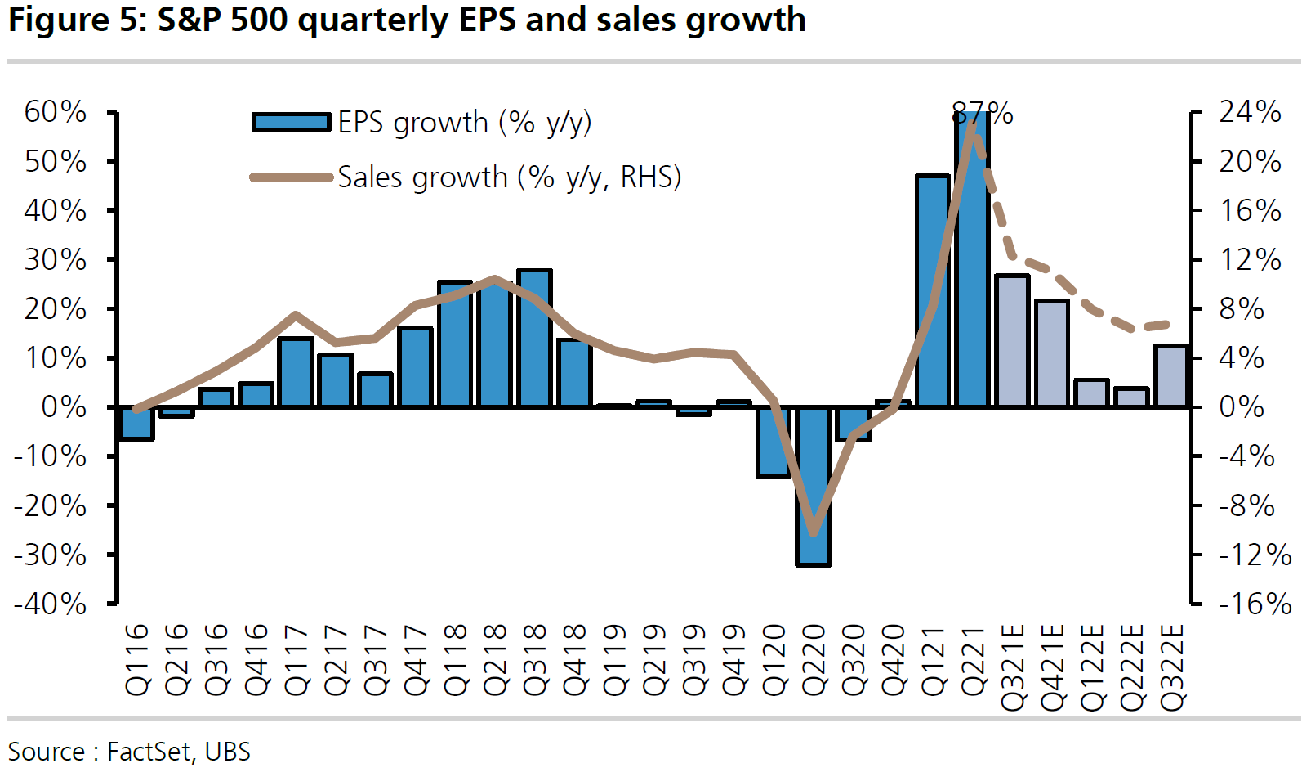

3. WANING EARNINGS AND GROWTH EXPECTATIONS

Coming off a weak 2020 comparison, 2Q21 had a strong EPS YoY growth. 3Q21 and 4Q21 also are expected to be positive, but the easy base affect will start to wane in 1Q22 and 2Q22 driving lower headline EPS growth rates. This will also be a time when continued cost and supply chain issues may pressure margins for companies. Overall, 2022 may come in as a lower EPS growth year compared to current and historic (ex-covid) years.

We believe there is a heightened level of volatility and risk compared to periods in the past for both equities and bonds. For equities there continues to be a divergence between individual stocks and the overall indices, increasing the value of being able to make individual stock decisions over holding indices or ETFs. While the credit risk of bonds remains near historic lows, the volatility in interest rates, especially a rising rate environment, poses ongoing risks to fixed income investments at current market spreads and prices. Overall we believe it will pay to be more tactical with investing going forward than the buy and hold approach that has been successful in the past.